[ad_1]

Each week we identify names that look bearish and may present interesting investing opportunities on the short side.

Using technical analysis of the charts of those stocks, and, when appropriate, recent actions and grades from TheStreet’s Quant Ratings, we zero in on three names.

While we will not be weighing in with fundamental analysis, we hope this piece will give investors interested in stocks on the way down a good starting point to do further homework on the names.

Five Below Could Go Lower

Five Below Inc. (FIVE) recently was downgraded to Hold with a C+ rating by TheStreet’s Quant Ratings.

Retail stocks have been in severe downtrends for months as they reflect the difficulty faced by consumers. Lack of goods and higher prices also are reasons for retailers’ struggles. The charts show us the same.

Five Below is in a wide range that is narrowing, but with lower highs and lower lows. Moving average convergence divergence (MACD) is about to roll over as price is heading toward the lower end of the range. That comes in around the $100 level. The Relative Strength Index (RSI) is bending lower as well.

Short FIVE at $120 or so and target the mid-$90s.

Winnebago Is Riding Downhill

Winnebago Industries Inc. (WGO) recently was downgraded to Hold with a C+ rating by TheStreet’s Quant Ratings.

Many years ago there was the “Winnebago indicator.” If the stock of this recreational vehicle maker was strong it meant the economy was very strong. If that correlation is still the case, the chart of WGO reflects pain for the economy with perhaps more to come.

The downtrend channel is well-defined here with lower highs and lower lows. Money flow is bearish and the Relative Strength Index (RSI) is bending lower here; also, the cloud is red and moving average convergence divergence (MACD) is starting to roll over. All bad signs for Winnebago, but good signs for a short position.

If short here target the high $30s ($38 or so) for a nice score, put in a stop at $52.

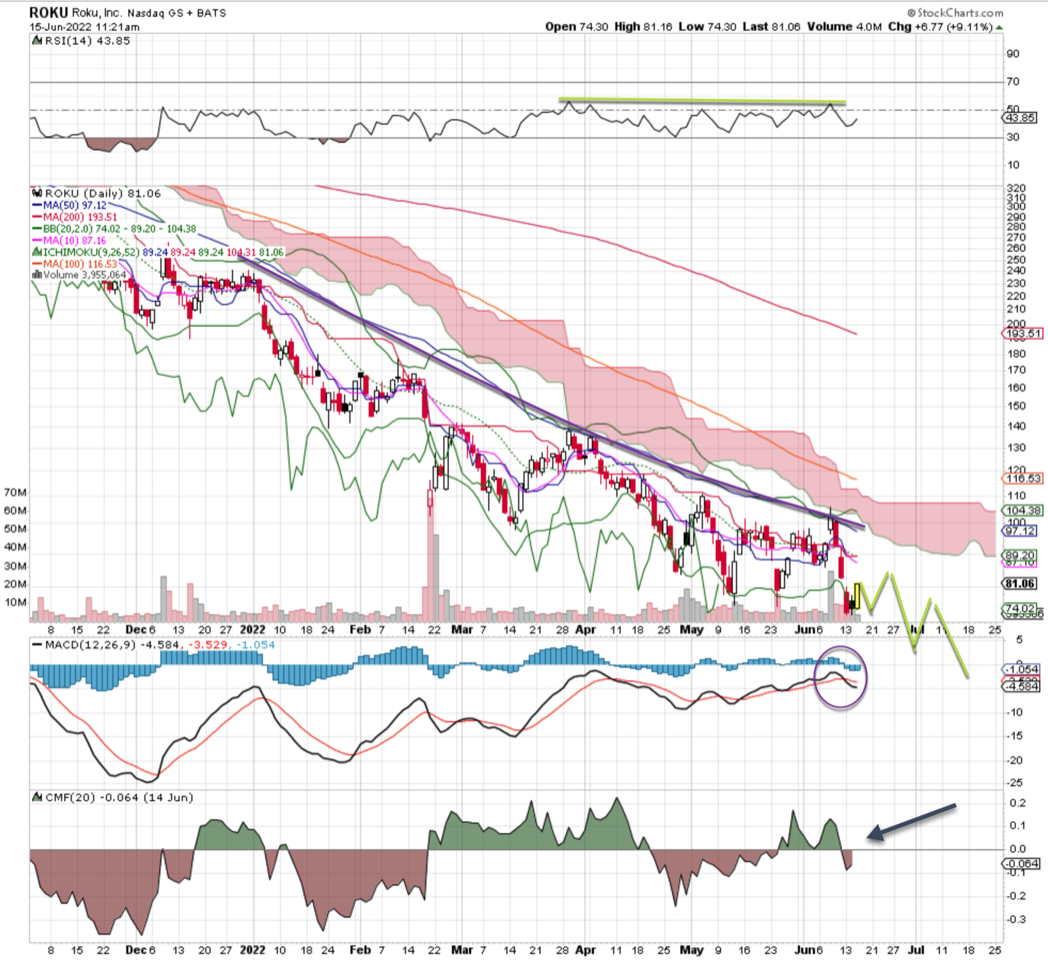

Roku Isn’t Clicking

Roku Inc. (ROKU) recently was downgraded to Sell with a D+ rating by TheStreet’s Quant Ratings.

The stock of the TV streaming platform operator has been rocked lately, as have most young growth names. The trend for months has been down, down, down. With lower highs and lower lows on the chart the stock rallies up to resistance and fails miserably.

Volume trends are extremely bearish, moving average convergence divergence (MACD) is rolling over and the moving averages are far above the current price. This one spells disaster and there could be much more downside to go even after a spectacular slide downward.

If short, target the low $70s, but put in an aggressive stop at $100.

(Real Money contributor Bob Lang is co-portfolio manager of TheStreet’s Action Alerts PLUS. Want to be alerted before AAP buys or sells stocks? Learn more now. )

Get an email alert each time I write an article for Real Money. Click the “+Follow” next to my byline to this article.

[ad_2]

Source link