[ad_1]

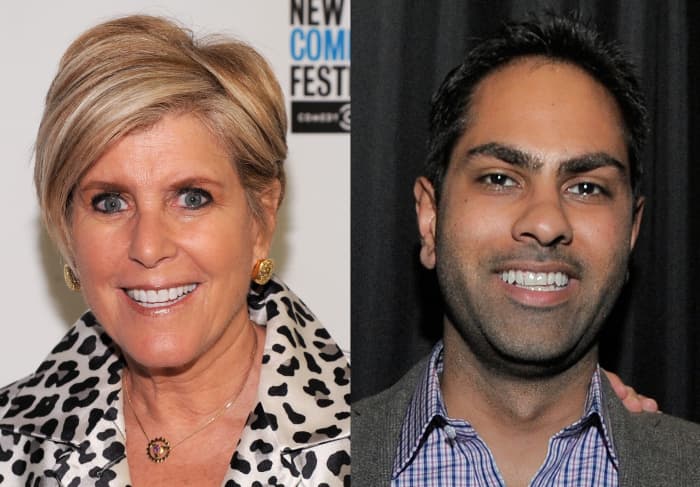

Suze Orman and Ramit Sethi

Getty Images

If you’re worried about inflation right now, you’re not alone. The consumer price index, which measures what consumers pay for goods and services, rose 8.6% compared to a year prior, government data revealed Friday. That’s a four-decade high, which no doubt, is worrisome to many consumer and investors. So we looked at what two financial bigwigs, Suze Orman and Ramit Sethi, as well as other pros, have told investors in the past about dealing with inflation (psst: both say you need to keep investing in stocks.)

Suze Orman: “Plan on many costs being double what they are today, and keep investing in stocks.”

In July, Orman wrote, “A 3% annual inflation rate might not sound so bad, but if you compound that 3% every year for 25 years, it means that what costs you $100 today will cost you more than $200 in 25 years.” So Orman, a financial advisor and host of The Suze Orman Show, recommends people keep investing in stocks because over the long-term, stocks have produced the best gains after factoring in inflation. “Bonds and cash struggle to keep pace with inflation; only stocks have a track record of earning more than inflation,” Orman says.

Ramit Sethi: “Investing is the single most effective way to get rich. Inflation can be bad for individuals when you just keep your money sitting in a bank account and do nothing else with it.”

Sethi, a self-made millionaire and author of I Will Teach You To Be Rich, says you need to “take a long-term view of your personal finances and that means choosing different investment options that allow you to make money despite events like recessions.” As an example, Sethi says, “Big banks pay about 0.01% interest on savings in 2018. This means if you put $1,000 in a savings account, you’d earn a whopping $0.10 per year. If your money is sitting in one of these big banks, you’d be losing money every day because inflation is 3%,” he wrote in 2018. (Though his example is from 2018, savings accounts today are also paying low interest rates too, so it’s still relevant.)

Also see: These are the types of companies Warren Buffett says you should invest in during times of inflation

What other pros say

Indeed, crunching the numbers show that investing for the long-term in stocks can pay off: According to data from Goldman Sachs, 10-year stock market returns averaged 9.2% over the past 140 years. Though, of course, stocks are not without their risks — which is why it’s important to have a well-diversified portfolio. “If you’re invested for the longer-term in a well-diversified portfolio, you’ve likely already got inflation protection built in. Staying invested and not holding onto too much cash are two sound ways to fight against inflation,” says Tiffany Lam-Balfour, investing and retirement specialist at NerdWallet. And as Snigdha Kumar, head of product operations for Digit, recently told MarketWatch Picks: “Investors should continue to be invested in equities, as stocks generally hold up better during times of inflation, especially if inflation comes with growth.”

[ad_2]

Source link