Shale baron Harold Hamm has hardly hidden his disdain for Wall Street’s environmental, social and governance movement, considering it a leash on companies such as Continental Resources as they try to get on with the job of producing more fossil fuels.

A climate change “religion” had gripped investors, he argued in an interview with the Financial Times last year, and companies such as European supermajor BP were about to “cut their [own] throat” by winding down oil operations under pressure to decarbonise.

Now, Hamm, who first took Continental public in 2007, has a chance to break free of Wall Street’s restraint, with a bid to buy the rest of the shares his family does not already own and return the company to private hands.

“Positioning ourselves as a private company will allow us to take maximum advantage of our greatest strength — our strong heritage as one of the leading exploration companies in the world,” he told employees in an email on Tuesday.

Analysts said the move could free Continental to do what public producers have for months been told by Wall Street not to: fire up drilling rigs to capitalise on a surge in oil prices to well above $100 a barrel.

Hamm and other public shale bosses watched as their privately held rivals sharply escalated drilling activity this year, unbothered by institutional investors insisting on scooping up their piece of the windfall.

Executives have often seethed in private about their difficulties in persuading ESG-focused portfolio managers in long-only funds to back more oil and gas exploration.

The shale pioneer’s move could tempt others to follow suit, using a cash flow bonanza to buy back shares they think have been unfairly discounted, concentrating them in a smaller group of loyal investors, analysts said. In theory, that smaller group could eventually take the entire company off the public market.

“Investors have stopped valuing the long term for oil and gas producers, so their market value is quite low,” said Raoul LeBlanc, vice-president of upstream at S&P Global Commodity Insights. “But every day the spiking commodity price is bringing in real cash, while spending on new wells is disciplined.”

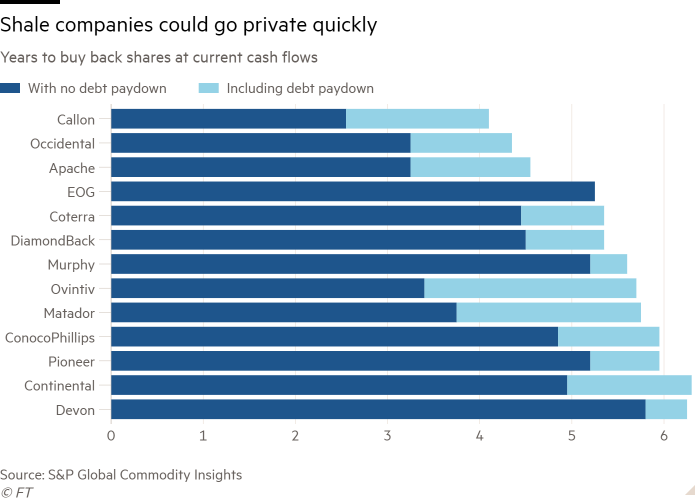

LeBlanc said the “highly unusual” situation means some of the largest shale companies “could theoretically buy themselves back entirely in less than five years”.

That includes Occidental Petroleum, whose debt pile increased by more than $28bn to almost $39bn in 2019 when it beat Chevron in a bidding war to buy Anadarko, another shale producer, just months before the coronavirus pandemic shattered crude prices and the US oil patch.

But Oxy is now generating more free cash flow than ever. Analysts expect it to pay its once-crippling debt load down to pre-deal levels by next year. Oxy’s share price remains depressed despite the financial performance, however, even as Warren Buffett’s Berkshire Hathaway has piled into the stock.

The combination means that at $100-a-barrel oil and current cash flow levels and equity prices, Oxy could buy back all its shares within three and a half years, according to S&P Global.

ConocoPhillips and Pioneer Natural Resources, the two biggest producers in Texas’s and New Mexico’s prolific Permian shale field, could do the same in less than six years, even while they keep paying down debt.

The cash influx and balance sheet strength mark a stunning turnround for an industry whose debt-fuelled drilling sprees took US oil output to a record high in 2020 — but left investors disillusioned with the poor returns.

US oil and gas stocks once made up about a quarter of the S&P 500’s value, but only account for around 4 per cent now — a reflection of investors’ disillusionment but also longer-term fears about the value of fossil fuel stocks amid efforts to combat climate change.

Even shares in Devon Energy, the S&P 500’s best performer last year, remain cheap enough that it could buy back its outstanding shares in less than six years, reckons S&P Global. The company has pledged $2bn in buybacks, roughly 4 per cent of its market value as of Tuesday.

And given the constraints on capital spending, share repurchases increasingly make sense, said Matt Portillo, an analyst at Houston investment bank Tudor, Pickering, Holt.

“If the market doesn’t start to recognise the value [shale companies are] creating through equity repurchases, you’re just going to continue to see shares gobbled up by management teams,” Portillo said.

In the next two to three years, several shale producers could buy back between 30 and 40 per cent of their existing market capitalisation just through free cash flow generation, leaving them an opportunity to privatise the rest, Portillo added.

He cited companies such as EOG Resources, one of the shale patch’s largest producers, which would have a “huge cash war chest by the end of the year” as income streamed in.

But even if other shale bosses would like greater control over their companies, Hamm and his family’s controlling stake in Continental make him a special case.

“Harold owns 83 per cent,” Pioneer chief executive Scott Sheffield said in an email. “[It’s] the key and big difference with others. I believe it would be very hard for others to do.”

And analysts cautioned that even if shale executives wanted freedom from Wall Street — and to drill as and when they pleased — they would still need to contend with efforts to clamp down on fossil fuel use to curb climate change.

“Shale companies may want to escape the scrutiny that is part and parcel with being a public company, but it is critical they don’t lose their focus on cutting emissions and playing a role in the changes in energy that are under way,” said Jamie Webster, a senior director at consultancy BCG’s Center for Energy Impact.