[ad_1]

Coupang, Inc. (CPNG) is a South Korea-based e-commerce company founded by Bom Kim back in 2010 and it got a favorable nod by a sell side firm Friday. Let’s check out the charts and indicators.

In this daily bar chart of CPNG, below, we can see that prices were cut from $45 per share to only $10 per share. CPNG has turned sideways after a decline and has rallied above the declining 50-day moving average line. The slope of the 200-day line is down and the indicator intersects around $21 or so. The trading volume surged at the March and May lows. The May low has been followed by a higher June low to break the pattern of lower highs and lower lows.

The On-Balance-Volume (OBV) line has moved sideways since the middle of January. The OBV line has been making a large bullish divergence when compared to prices the past few months. The Moving Average Convergence Divergence (MACD) oscillator is close to crossing back above the zero line for a new outright buy signal.

In this weekly Japanese candlestick chart of CPNG, below, we can see a hammer pattern in early May which turned the trend from down to sideways. The weekly OBV line shows uneven improvement from October. The MACD oscillator is bearish but has just crossed to a cover shorts buy signal.

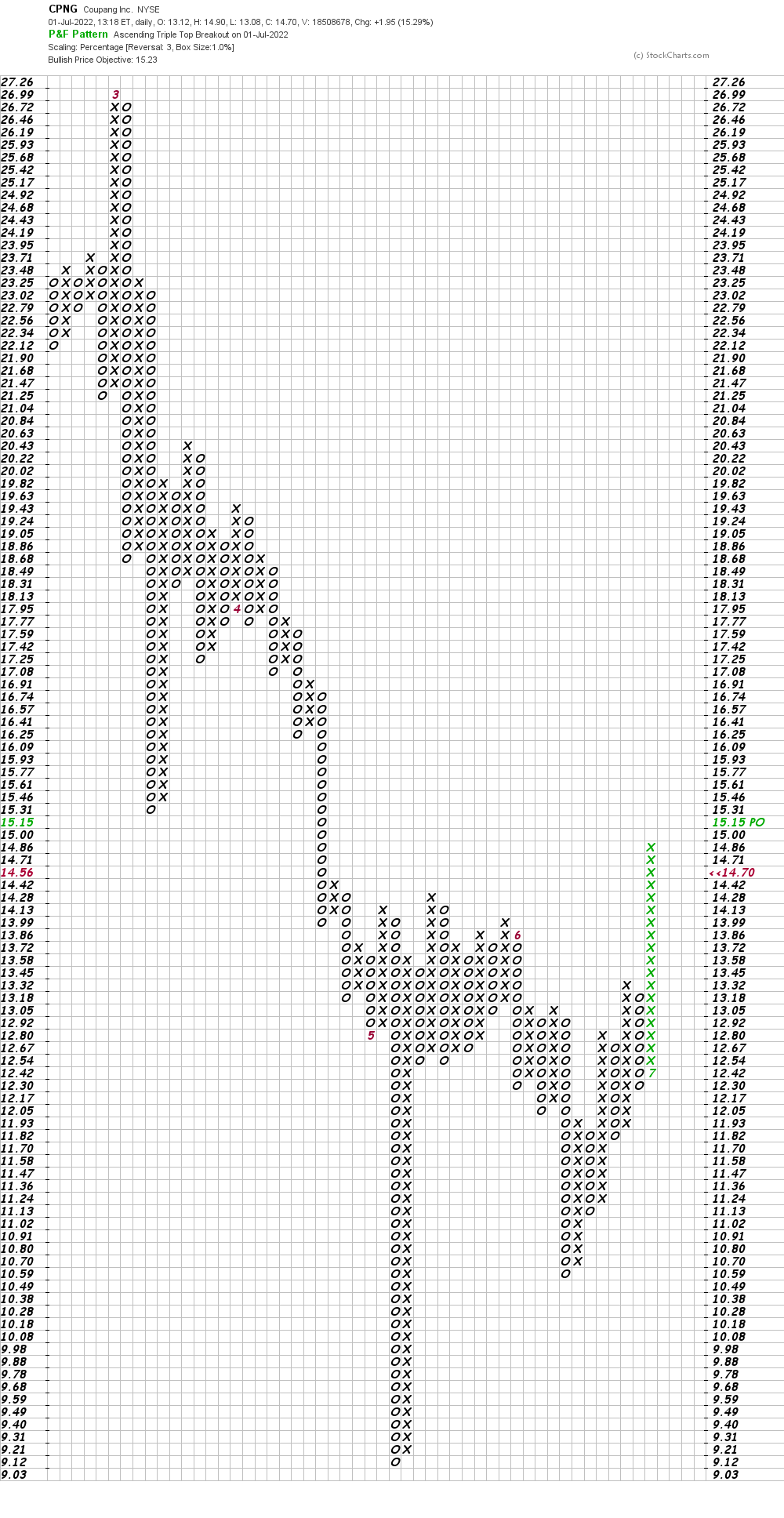

In this daily Point and Figure chart of CPNG, below, we can see a nearby price target of $15.23.

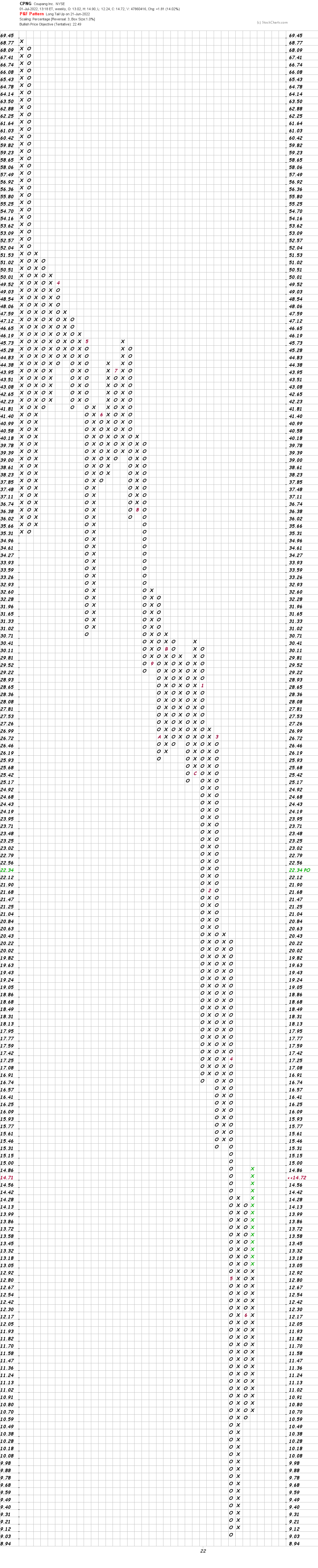

In this weekly Point and Figure chart of CPNG, below, we can see an upside price target in the $22 area.

Bottom line strategy: CPNG could trade sideways a while longer building its base pattern. Nimble traders could probe the long side at current levels. If prices rally in the near-term traders could use that strength to take quick profits. Risk to $9.

Get an email alert each time I write an article for Real Money. Click the “+Follow” next to my byline to this article.

[ad_2]

Source link