[ad_1]

Macerich (MAC) owns and operates Class A (high-end) malls spread across the United States. Like all mall owners, its business was savaged during the Covid-related, government-imposed shutdowns of 2020.

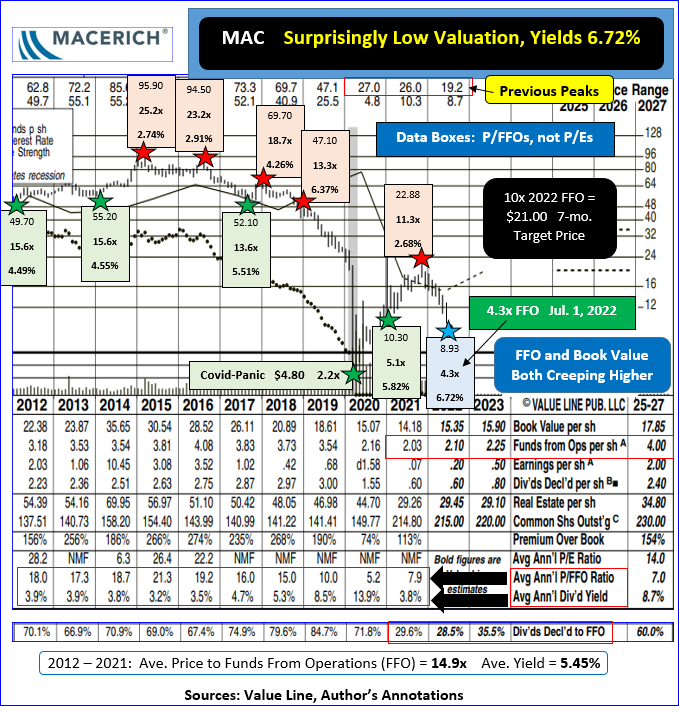

Funds from Operations (FFO), the preferred method for valuing real estate investment trusts, or REITs, declined significantly. Dividends were reduced. The shares fell from about $27 early in 2020 to a momentary nadir south of $5.

Brave souls who bought near that low got a short window to cash out near $26 early in 2021 when the meme-trading crowd picked up on it in chat rooms.

It quickly fell back to $10.30 afterward before rallying once again. When the broader market peaked in November of last year, Macerich was back to north of $22.

What a difference the past seven months has wrought. Macerich steadily retreated to a new 2021-2022 low of $8.42, intraday on June 30.

What is so amazing about the extreme volatility in the stock? Book value and FFO are both on the improve versus 2021. Further gains in both categories are expected in 2023 and beyond.

Management was prudent in cutting back the dividend rate due to the Covid period. The payout ratio ranged from 67% to 84.7% during the nine pre-Covid years. Over the more recent two years, dividends represented less than 30% of FFO, helping firm up Macerich’s balance sheet.

I applaud them for that. Value Line thinks Macerich will raise quarterly payments again during 2023.

What is Macerich really worth?

The entire decade from 2012 through 2021 saw Macerich’s average P/FFO run about 14.9 times. A typical yield was around 5.45%.

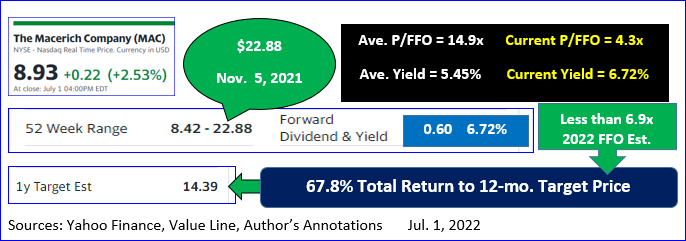

As of July 1, those metrics were 4.3 times FFO accompanied by 6.72% in yield. Project a return to only 10 times FFO over the coming year and $21 becomes a realistic, if not conservative goal.

That modest assumption suggests potential total return of nearly 142%. Note, too, that Macerich far exceeded that target price just eight months ago.

Reverse engineer the current dividend rate to a more typical 5.45% and you come up $11. That is much lower than I think Macerich is worth but even a move back to there over the coming 12 months would deliver a very acceptable 29.9% total return.

Yahoo Finance’s view on Macerich falls between my two calculated goals. They see it at $14.39 by this time next summer projecting 67.8% in total return. Yahoo Finance’s goal appears low, however, as it assumes a final P/FFO of less than 7 times their own estimate for 2022.

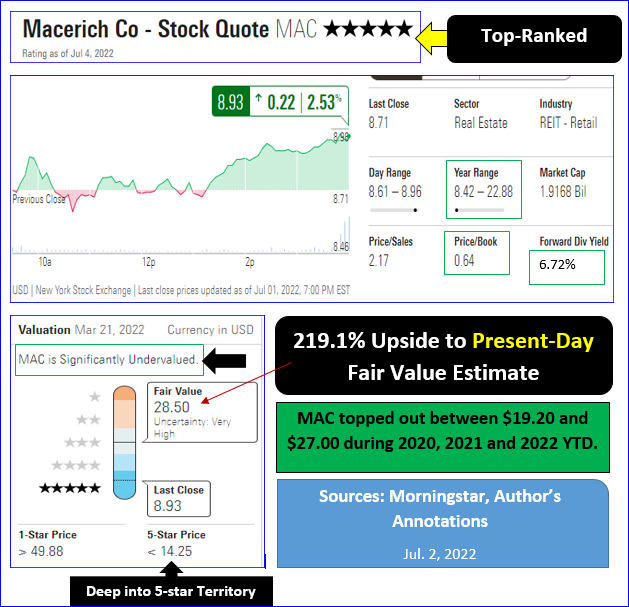

Independent research house Morningstar is quite bullish on Macerich. It now carries their highest, 5-star, buy rating.

Better still Morningstar sees present day fair value for Macerich as $28.50.

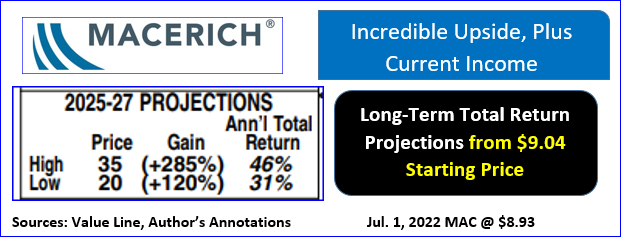

Longer time frames suggest ever higher fundamentals as the Covid crisis fades away into more normal times.

Value Line calls for Macerich to reach between $20 and $35 per share not later than 2027. The hefty total return projections shown below were calculated when Macerich was $9.04, rather than $8.93.

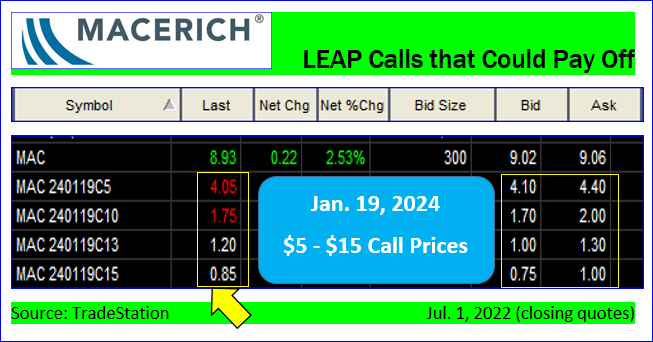

I rarely even think about buying call options. In this case, though, with Macerich very depressed in price and its Jan. 19, 2024, expiration date options selling relatively cheaply, it might be worth a play.

Actual pricing on those LEAP options at strikes from $5 to $15, are shown below, with Macerich at $8.93.

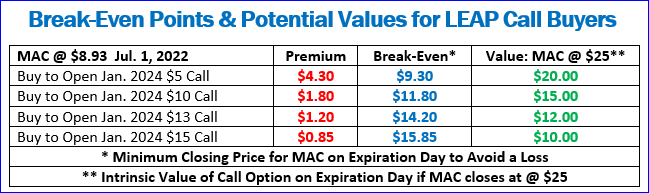

Break-even points ranged from $9.30 to $15.85 on relatively low-cost premiums of 85 cents to $4.30 based on the bid-ask spreads, not the somewhat stale last-trade prices for the $5s and $10s.

With 19 months to go before expiration day, Macerich might easily reach $25 by then.

The graphic above shows the minimum worth at intrinsic value if held through expiration. Potential gains could be quite large if Macerich does what I expect.

Call buying is a dangerous game. Preset time horizons can leave you with up to 100% losses on all call premium paid if the underlying shares don’t perform well. The technique is only for traders willing to take large risks for potentially big gains.

The safer route is to simply buy Macerich shares, collect the generous dividends and reap the rewards when valuations revert back to normal.

Get an email alert each time I write an article for Real Money. Click the “+Follow” next to my byline to this article.

[ad_2]

Source link